There are two primary ways that a business can be bought or sold:

- a stock (or equity) sale or

- an asset sale

The most common method, by far, is the asset sale, but that doesn’t mean an asset sale is the best option for you. Many factors influence what deal structure will maximize your benefits (including whether you’re the buyer or the seller in the transaction), and you should get professional advice on these factors.

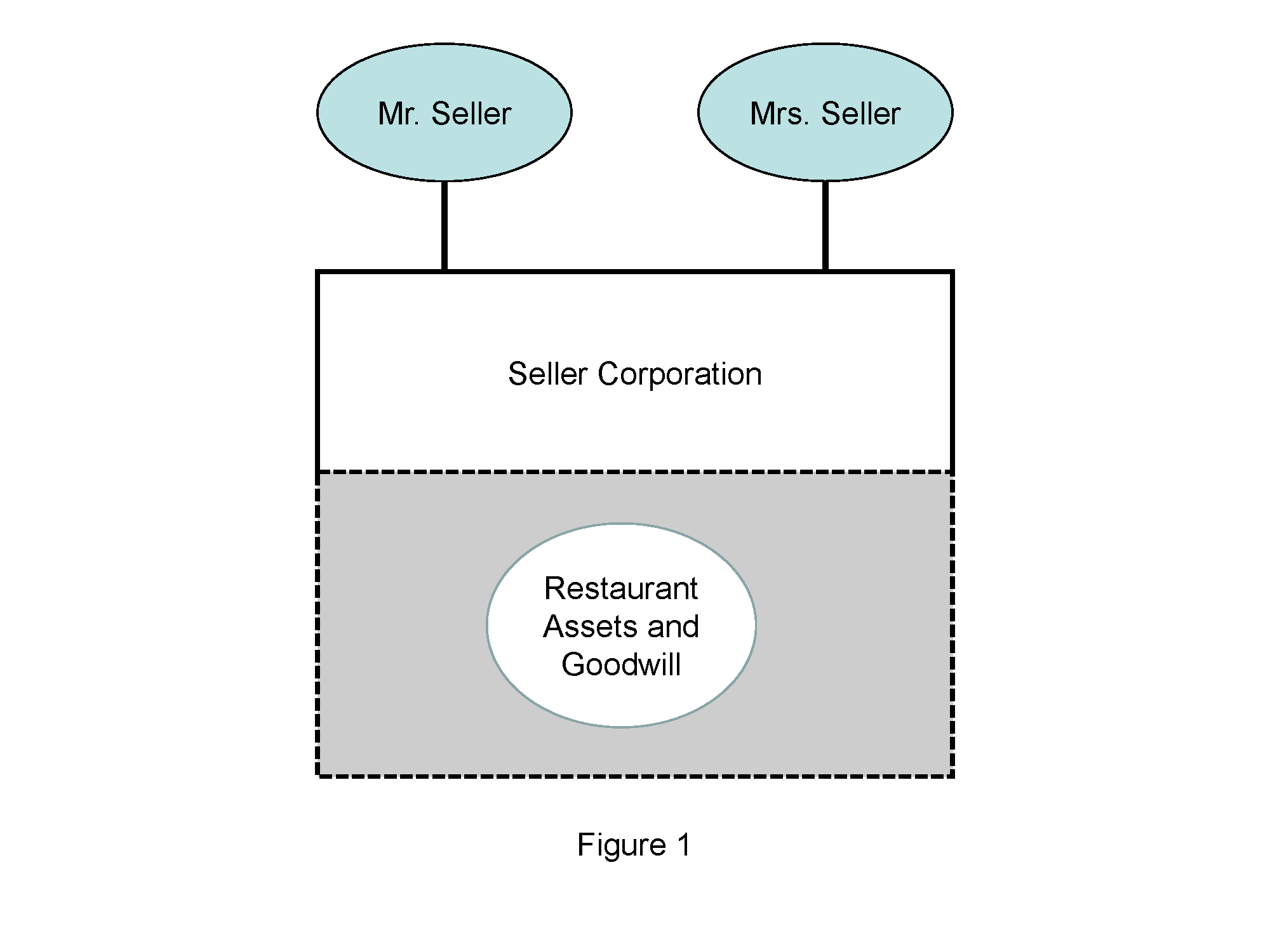

To show how these two types work I’ll use a fictional business owned by “Mr. and Mrs. Seller” and operated through a cleverly named corporation, “Seller Corporation.” Mr. and Mrs. Seller are the only shareholders, and, through Seller Corporation, they own all of the assets and operate the business. This set up is shown in Figure 1.

In our scenario here, Mr. and Mrs. Seller plan to sell the restaurant. Enter “Mr. Buyer,” who decides that he’d like to buy the business and try his hand as a restauranteur.

Stock Purchase

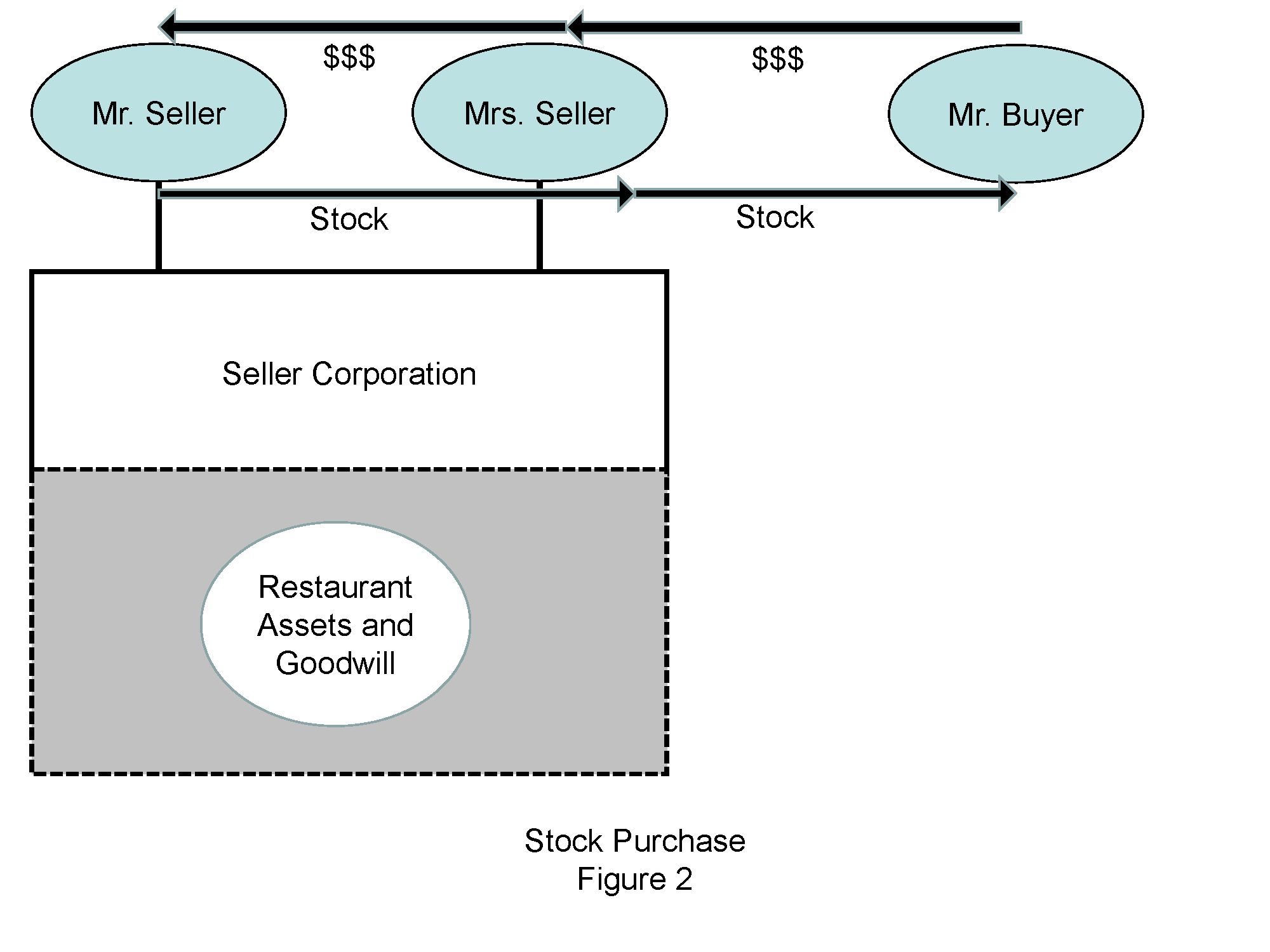

The first option is a stock purchase. In this arrangement, shown below in Figures 2 and 3, Mr. and Mrs. Seller, as the only shareholders of Seller Corporation, enter a stock purchase agreement with Mr. Buyer. Mr. Buyer purchases the stock (ownership or equity) of the corporation directly from Mr. and Mrs. Seller by paying them the purchase price. Mr. and Mrs. Seller transfer their shares of stock to Mr. Buyer.

Once the transaction is complete, Mr. Buyer becomes the sole shareholder of Seller Corporation, and, through it, the owner of the restaurant and the business assets (Figure 3). The Corporation itself remains unchanged with all of its assets and liabilities, but now it has a new owner.

Asset Purchase

The second option is the asset purchase. As seen in Figure 4, with an asset purchase, Seller Corporation sells all of its assets, both tangible and intangible, to Buyer Corporation, a business entity owned by Mr. Buyer.

Mr. Buyer contributes cash to Buyer Corporation. It uses that cash to pay the purchase price to Seller Corporation and to fund the initial operating expenses of the business. Then, Seller Corporation transfers the business and all of its assets to Buyer Corporation.

Once the transaction is complete, Seller Corporation usually distributes the money to Mr. and Mrs. Seller and is dissolved.

The assets transferred by Seller Corporation to Buyer Corporation typically include all its furniture, fixtures, and equipment used in the business (FF&E for short), as well as the tradename, other intangible property, and goodwill. Buyer Corporation also assumes all or a portion of Seller Corporation’s customer contracts and future liabilities, such as, the future rent on the real property lease.

When the asset purchase is complete, the restaurant and its assets are owned by Buyer Corporation, and Seller Corporation owns only the proceeds from the purchase (cash and, possibly, a promissory note made by Buyer Corporation to Seller Corporation and guaranteed by Mr. Buyer). See Figure 5.

Why an Asset Purchase?

It is a fact that the vast majority of business sales structured as asset sales. But why?

In short, they are preferred by the buyer for two important reasons:

- Protection from Liabilities, and

- Tax Management (i.e. depreciation and amortization)

Liabilities

The buyer of the stock of Seller Corporation is stuck with, and has to satisfy all of, the Corporation’s liabilities, whether known or unknown. For example, if Seller Corporation hadn’t paid its employment taxes, Seller Corporation will have to pay them even though the Mr. Buyer is a new owner.

Though this isn’t the personal liability of Mr. Buyer, from his perspective it may as well be. He has just made a significant investment to buy the business, and whatever money he paid for it is at risk if the liabilities aren’t paid; he could lose his entire investment. Even if Mr. Buyer can sue Mr. and Mrs. Seller, litigation is costly and time-consuming, and collections can be an issue.

On the other hand, an asset purchase allows Mr. Buyer to take over the restaurant with limited or no liabilities. Prior to the sale, he has the option to select which liabilities of Seller Corporation he would like Buyer Corporation to assume, if any. Most, if not all, of the other liabilities would remain with and have to be paid by Seller Corporation before it can distribute the purchase price to Mr. and Mrs. Seller.

It is important to note that not all liabilities can be left behind in an asset purchase. For example, any claims that are liens on the assets (e.g. for unpaid taxes) must be satisfied or the assets could be levied upon. Also, in Florida, in particular, the Buyer Corporation must pay the delinquent sales taxes of the Seller Corporation.

Tax Considerations

Sales also involve tax management, specifically how to minimize the tax burden or maximize tax benefits.

The tax situation with a stock sale is straight forward. Mr. and Mrs. Seller pays tax on the “gains” (read: profit) they receive from Mr. Buyer at capital gains tax rates, which, as I write this, are between 0% and 20% for long-term capital gains.

Sellers often prefer stock purchases for precisely this reason: a low tax burden.

The tax situation with an asset purchase is more complex and depends on the tax structure of Seller Corporation: Is it a “C” corporation or a pass-through entity such an “S” corporation or a limited liability company that’s taxed as a general partnership or sole proprietorship? Factors can include the year-to-date net income of Seller Corporation the value of the tangible and intangible assets, and the amount of depreciation taken by Seller Corporation in the past.

C Corp. Asset Sale

If Seller Corporation is a “C” corporation, then the business entity will pay tax on the gains from the sale of the assets at a rate of 21% (2018 and after). When Seller Corporation distributes the after-tax the proceeds to Mr. and Mrs. Seller, they also pay tax on their individual gains at a rate of approximately 15%.

As a result, the income is taxed twice. The combined rate is approximately 32.85%, much higher than the capital gains tax paid in the stock purchase transaction.

For this reason, if Seller Corporation is taxed as a “C” corporation, in addition to the transfer of assets to Buyer Corporation, Mr. and Mrs. Seller will often transfer their personal goodwill outside of the sale of assets by Seller Corporation and receive part of the purchase price directly to avoid part of the double taxation.

Pass-Through Entity Asset Sale

If Seller Corporation is an “S” corporation or a limited liability company taxed as a partnership, Mr. and Mrs. Seller will pay taxes from the purchase price as a distribution of the net income of Seller Corporation, then as “depreciation recapture,” and finally based on the assets and goodwill of the business.

Unlike the “C” corporation, this income is taxed only once, and the tax is paid by the shareholders, Mr. and Mrs. Seller.

The tax rates vary based on these factors. But, most often, a portion of the net proceeds will be taxed as ordinary income (10%–37%) and a portion will be taxed as capital gains (0%–20%).

Depreciation and Amortization

Depreciation is the ability of a business to deduct from its income each year a portion of the cost of its tangible assets and the cost of purchasing certain intangible assets. Depreciation is permitted to allow the business to recover the cost to replace the asset as the asset wears out. Certain provisions of the tax code permit deductions of the value of purchased assets at a higher rate. Some even permit the entire value to be deducted (or expensed) in the first year. Depreciation and amortization deductions are “non-cash” expenses that create tax-free income for the business.

In simple terms, if Seller Corporation purchases a computer system with a seven-year useful life for $14,000.00, it can deduct $2,000 (one-seventh of the cost of the machines) from its income each year for seven years. This way the business will, in theory, have $14,000 to purchase new computers when the current ones wear out.

Now, the machines may continue to work after they have been fully depreciated, but that doesn’t matter. It only means the business cannot take the depreciation deduction any longer.

Typically, for equipment purchases, the depreciation deduction would be spread out over a 5- to 15-year period, depending on the type of equipment. However, new equipment is generally more productive in the first few years of operation than in its later years. To account for this, additional provisions in the tax code allow owners to front load the depreciation a bit, or, even better, to fully depreciate an asset in the first year. So, if Seller Corporation had purchased a piece of equipment that meets the requirements of Section 179, it could opt to expense 100% of the cost that asset in the year it was put into use.

The IRS classifies the depreciation schedules for property in IRS Pub. 946. This is a 114-page document, and, as you can expect, it isn’t exactly a page turner. The provisions are nuanced and sometimes subjective, so it’s important to consult a professional to make sure you don’t run afoul of the IRS.

How and why does this matter? Well, depreciation isn’t limited to the purchase of brand-new equipment, it also applies to “new-to-me” equipment. So, when Buyer Corporation purchases the assets from Seller Corporation, it can still depreciate the cost of those assets.

Even better, the tangible assets will likely qualify for a Section 179 deduction! This would let Buyer Corporation expense 100% of the cost of the purchased assets in the first year. Depending on the value of those assets, it could considerably reduce the taxable income for that year (and thereby reduce the tax Mr. Buyer must pay on that income) and recover a fair portion of the purchase price in the first year.

Let’s look at some rough numbers. Say Mr. Buyer purchases Seller Corporation’s business through an asset sale for $500,000. Of that amount $70,000 is allocated to the furniture, fixtures, and equipment (FF&E) and the balance to goodwill.

If we assume that all of the FF&E have a useful life of seven years, then for the next seven years the first $38,666.00 of income from the business is tax free. The first $10,000 represents the depreciation of the $70,000 of tangible assets over 7 years. The balance of $28,666, is the amortization of the $430,000 of goodwill over 15 years.

Even at the standard depreciation schedule, the deduction is considerable. Obviously, $38,666 of tax free income for the next 7 years is very important for the buyer and helps debt service. But as we saw, the deduction could increase significantly if the purchase was written off as a Section 179 deduction. In that case, the first-year deduction would be $98,666: $70,000 for the FF&E and Section 179 deduction, and $28,666 for the amortization of goodwill.

Importantly, depreciation, amortization, and Section 179 deductions are usually available to the buyer only when the sale is completed through an asset sale. With a stock sale, the owners of the assets—the Corporation—doesn’t change, and the tax arrangements remain the same as they were before the sale. Therefore, whatever prior depreciation was taken is not available to the buyer.

Asset Allocation: Some Negotiation Required

As you may have noticed, often what’s best for the seller is bad for the buyer and vice versa. Generally, the seller wants to allocate as much of the sale price as possible to goodwill and other intangibles (for capital gains tax treatment), but the buyer wants to allocate as much as possible to tangible assets, which can be depreciated.

If Mr. and Mrs. Seller get their way, more of the purchase price is amortized and deducted over 15 years. If Mr. Buyer gets his way, the Mr. and Mrs. Seller pay ordinary income tax rates on a greater depreciation recapture.

Navigating the sale process requires careful consideration and negotiation of the structure. These decisions can make or break the transaction and significantly impact what you walk away with as the seller or what you pay as the buyer.

Insider Secrets to the Business Buying Process

Buying a business can be tricky. We’ve simplified the process into 7 easy steps. This book is your go-to resource to learn why buying a business is your path to success and financial freedom.

Request a free copy of our new book!

How Can We Help You?

Here at Alexander Abramson, we focus exclusively on business-related legal matters. Our attorneys have advised closely held businesses and business owners for decades on buying and selling businesses.

Ed Alexander is also a Florida licensed business broker and a shareholder of Fitzgibbon Alexander, Inc., a Central Florida business valuation and brokerage firm.

We would love to speak with you directly about how we can help you buy or sell your business. Call us 407-649-7777 or email a team member to get the process started.