Owning and operating a business, being your own boss, is an inextricable part of the American Dream. However, many people believe that starting your own business or buying an existing business is too risky a proposition. Instead, they will consider buying into a franchised operation. Because the concept has been accepted in the market and, at least for some, has led to success, they assume the risk is considerably less.

If you’re thinking about buying into a franchise, I urge you to proceed carefully. Yes, many entrepreneurs have had tremendous success opening and operating franchises, but many have failed too! Like a startup, opening a franchise can be a path to financial freedom, if done right. But it can quickly lead you down a path toward financial ruin if you rush in blindly.

Between the franchise fee—which can range from $25,000–$75,000—the build-out costs, working capital, and the 6 months to 1 year of living expenses, franchisees can end up spending over $300k open a franchised business. Moreover, many franchises set minimum requirements for liquid assets and net worth for potential franchisees (e.g. Dunkin’s cash requirement is $125,000, Taco Bell’s is $360,000, and McDonald’s is $750,000!).

That’s often much more than it would cost to start an independent (i.e. non-franchised) business or to buy an existing business.

Franchise buyers justify the additional expense because they believe the proven and in-place concept and systems of the franchise give them a higher chance of success.

But are franchises truly less risky? Do they provide security? Are they worth the money?

A Pseudo-Safe Choice

The answer to whether franchises are less risky has been misinterpreted (wittingly and unwittingly) for decades. We begin in the 1980s, when the U.S Department of Commerce published the results of a voluntary survey of franchisors. The voluntary survey respondents reported a 5% failure or closure rate within five years.

Without accounting for the limited data size or the voluntary nature of the survey—e.g. many out-of-business franchisors were unlikely to respond!—some people within the franchise industry inverted and extrapolated the survey data to claim: If 5% of respondents reported failing, then 95% of franchised businesses must’ve been successful. Even without a PhD in Statistics, you can see how extrapolating from this voluntary survey of a small population to the failure and success rate of an entire industry is, at best, disingenuous, and, at worst, deceitful.

Throughout the following decades, faulty claims about the success rates for franchises, including the erroneous “95% success” statistic, became ubiquitous. As they spread, they helped solidify the belief that franchises were “less risky” than independent businesses and that buying a franchise increased the likelihood of business success.

Despite numerous organizations having disavowed such statistics, including the SBA and the International Franchise Association (IFA), they have persisted. In 2005, the IFA President even issued a written notice to its members to stop including these false and outdated statistics on their websites.

For entrepreneurs who are considering buying a franchise, inaccurate information poses a real problem. Perhaps, they’ve heard that franchises are less risky, but they want to double check. Depending on how adept our budding entrepreneur is at sorting spurious from sound information in an online world, a short burst of online research may even fuel this fabricated fire.

A cursory glance at the wrong source can convince someone that the success rate for franchises is tremendously high.

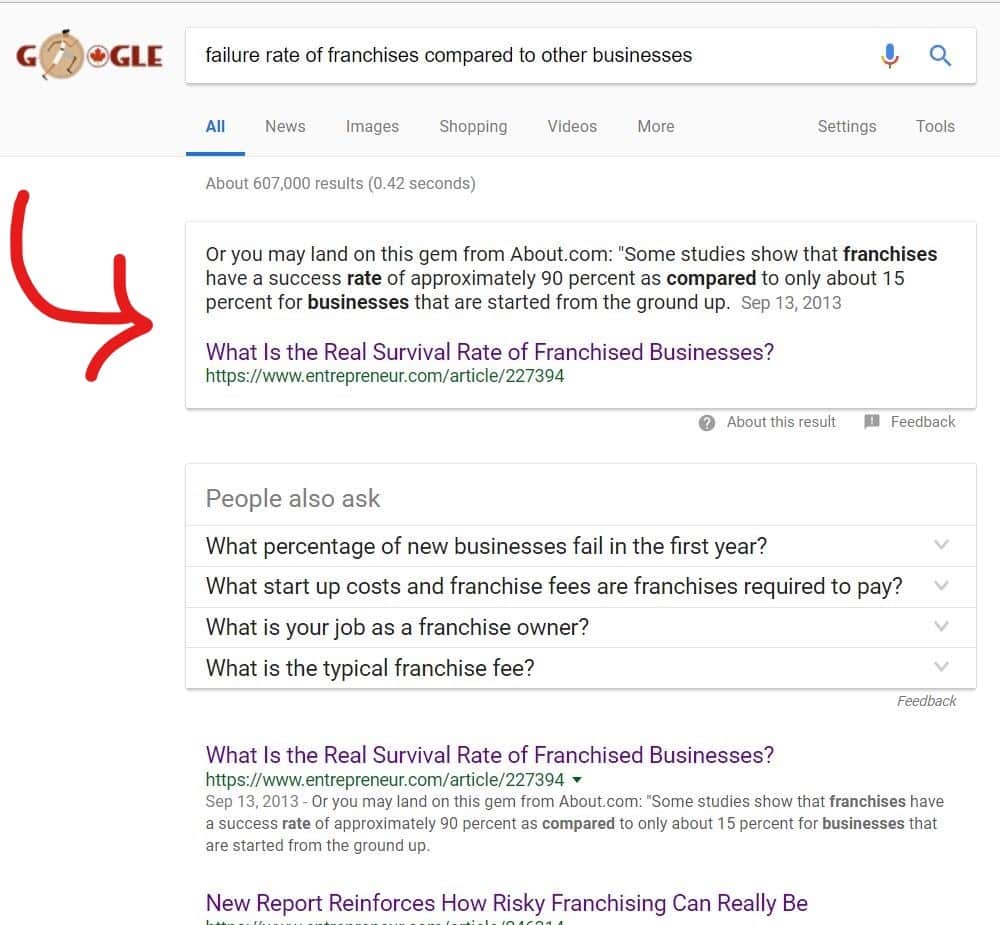

Take this Google snapshot, here. I queried: Failure rate of franchises compares to other businesses.

The “snippet” is quite unfortunate. If you tend to skim online media, you could potentially take away that 90% of franchises succeed. However, the article cited there is arguing, exactly as I am, that these false statistics have been bandied about for decades.

The Answer is NO

As you have probably gathered by now, not only is the “95% success” statistic false, but new data from the U.S. Small Business Administration suggests that the answer is, no, franchises are not less risky than independent businesses.

That’s right. Based on SBA loan default data from the 2000s, the SBA discovered that franchised businesses had a 6% higher failure rate than independent businesses.

The two big takeaways from the SBA research were:

- Starting an independent business was less risky than buying into a franchise system, and

- Independent entrepreneurs are in business longer and do better financially than franchised businesses.

But franchise industry insiders properly caution against reading too much into these new data. President of FranNet, a franchise brokerage, Jania Bailey points out franchises are multifaceted: There are new franchises and mature franchises; they operate across 80+ industries; finding a single success or failure rate that would accurately describe this entire landscape would be difficult.

So, who is right? The answer is probably somewhere in the middle and will be determined by “micro”-economic and personal business factors: e.g. your personal business and management skills, your sources of capital, the particular franchise you’re buying, the location of your franchise, etc.

Down with the Ship

When buying into a franchise, entrepreneurs face an addition problem: Your success isn’t only based on your performance. This is especially true of newer franchises or franchises that are incapable of adapting to a changing market.

In 2010, Entrepreneur Magazine published two articles on the repercussions of franchise flops (undoubtedly, many more have since been published). The first cataloged several recent franchise concepts that had failed, including eBay drop-off stores, meal preparation stores, and dating franchises. The second told the story of how one franchisee dealt with the bankruptcy of the Cork and Olive franchise system.

This may not seem like a huge problem, since we tend to equate “franchise” with well-established operations like McDonalds, Wendy’s, or 7-Eleven; this or that store may shut down, but “Wendy’s” will keep slinging Baconators. But new franchises pop up all of the time and then fade just as fast. Often, a concept meets with success and a wave of competitors follows suit. You can think back to the frozen yogurt boom of the early 2010s or the smartphone and tablet “i-” repair stores that in 2019 pepper strip malls across the country.

However, additional SBA research also determined that 56% of franchise systems did not exist within 4 years after they started franchising, and a full 75% of franchise systems did not exist within 10 years.

What happens to the franchisees that bought into those franchise systems? Even though they paid tens of thousands of dollars of franchise fees for support and assistance, they no longer have it. If they buy products from the franchisor, they can’t get inventory. They’re left on their own.

That certainly sounds risky.

You may wonder if all franchisors are at risk? The answer is that not all franchise systems are the same. There are good ones and bad ones. Your goal as a potential buyer is to figure out how to tell the difference.

Play It Safe

Franchising is a vital part of the American economy both for entrepreneurs and for the work force. Many entrepreneurs across the country (and the world) have been massively successful opening and growing franchised businesses. And just like with independent businesses, franchises come with a certain set of risks. The important thing for you, the entrepreneur, is that you embark on this opportunity with full and accurate knowledge of the risks involved.

In order for a franchise opportunity to be a good opportunity, there are a few key points to keep in mind:

- Big and bold. You need get into business faster and make more money than you would in an independent business. Brian Headd, at the SBA Office of Advocacy, says that, for a franchisee, the more money you have at startup and the faster you can start, the more likely you are the stay in business. This means that franchising isn’t going to be for everyone. A lot of pieces need to line up for a franchise to be the right fit for you.

- Proven, but adaptable concept. You need to make sure that the franchisor has staying power. This will require research on your part into the franchise and the industry. Be wary of jumping onto trendy bandwagons. Also, don’t assume that just because a franchise has been around for 20 years that it will be here tomorrow. A business needs to have a sound concept and be able to adapt to a changing market. Don’t be the thousandth fro-yo shop or a Blockbuster.

- Cash in and duck out. You should make sure this is a business opportunity that you can run and expand now, but exit later in order to realize the wealth you’ve created for yourself. As with any business, you should begin planning for your exit at the beginning.

All of these points are addressed in the Franchise Disclosure Document (FDD) and the Franchise Agreement, which you will receive from the franchisor. The FDD can run to hundreds of pages, and despite your urge to skim over its 23 “items” as legalese, they are vital to decide whether the franchise you are considering is a good opportunity for you. You will find information disclosed in that document concerning the franchisor’s business background, its legal relationship with franchisees, the startup costs and ongoing costs of your franchise, and much more.

Get advice from a trusted, experienced professional about this information to determine whether the franchise is capable of offering you the keys to success or whether it’s going to lead you down the path to financial ruin.

Your Path to Personal and Financial Freedom

Buying a business can be tricky. We’ve simplified the process into 7 steps. This book is your go-to resource to learn why buying a business is your path to success and financial freedom.

Request a free copy of our new book!

Let Us Help You Buy a Business!

Here at Alexander Abramson, we focus exclusively on business-related legal matters. Our attorneys have advised business owners and entrepreneurs on acquisitions of both franchised stores and independent businesses.

Our staff strives to create a wonderful client-experience by actively listening and maintaining open lines of communication, consistently meeting deadlines, and being upfront about our pricing and services.

If you’re considering buying a franchised business, call us at 407-649-7777 or email a team member to tell us how we can help. We provide Franchise Agreement and FDD review, as well as other business buying services to make sure that your new business purchase is successful and profitable.